Written by: Henry W. Olson

9|1|2020|Advertorial

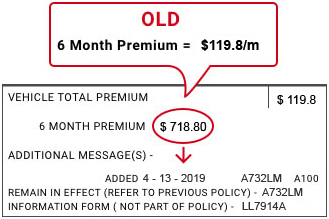

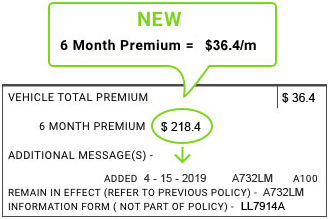

Thousands of drivers are discovering that they are paying way too much for auto insurance, because they are not aware of all the discounts they qualify for. Hundreds of auto insurers were reviewed, it was found that about only a dozen of them gave very big discounts to low mileage drivers who drive less than 50 miles per day.

Thats right, if you drive 50 miles a day or less and live in a qualified zip code you could qualify for a high discount. Most people assume they have a good deal on insurance, but surveys show this is not the case, most drivers are actually over paying for auto insurance.

CompareQuotes.com is an unbiased site that is always up to date on any laws or rules at both the federal and state levels that affect insurance rates. This information is used to match drivers to the right insurance companies that will offer the most discounts.

Some auto insurers will offer a large price reduction if you have not gotten a ticket in the last 3 years or no DUI’s. It also helps if you have had no car accidents in the last three years, this can lower your insurance premium even further.

Your age is also a big factor, after the age of 25 is when the biggest drop in rates occur. As you mature and reach the age of 40 then 55 you gain more discounts. As a senior citizen you can qualify for even more discounts such as “retirement” or “experienced driver” discounts.

Which drivers are likely to qualify for the most discounts?

Drivers who:

How is it that the public is not aware of this information? Auto insurance companies and agents are focused on selling a higher premium since that is what is most profitable for them. However when you use a service like Comparequotes.com these insurance companies have to compete with each other by offering lower insurance premiums. The solution-compare quotes between multiple insurance providers to find the insurance company that best suits your life circumstances offering the most discounts. You could save as much as 48% on car insurance.

IMPORTANT: You can cancel your current auto insurance at any time, even if your premium is paid in full. Your insurance company will reimburse you.

Step 1: Just tap your age below and enter your zip code on the next page.

Step 2: After you enter your zip code and some driver information, you can compare quotes from top rated auto insurance companies and agents near you offering a savings of up to $600 a year.Step 3: Click on 2 or more quotes to get the best deal.